Sugar Alternative Market Scope

The Sugar Alternative market industry is projected to grow USD 25.15 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 4.52% during the forecast period (2023 - 2032).

Eminent Vendors

Eminent companies in the global Sugar alternative market include E. I. du Pont de Nemours and Company (U.S.), Ingredion Incorporated (U.S.), Tate Lyle PLC (U.K.), Cargill, Incorporated (U.S.), Ajinomoto Co., Inc. (Japan), Archer Daniels Midland Company (U.S.), Roquette Freres S.A. (France), and more.

Segmental Review

A sugar alternative market research report has been considered for type, application, and distribution channel.

Types of sugar alternatives include high-intensity sweeteners, low-intensity sweeteners, and high-fructose syrup. High-intensity sweeteners can be divided into Aspertame, Stevia, Sucralose, Cyclamate, Ace-K, Saccharin, and others. In the high-intensity sweeteners segment, the highest growth is noted for aspartame, which is used extensively as a low-calorie artificial sweetener. It is roughly 200 times sweeter than sugar and is particularly utilised as a food additive in sweets, desserts, drinks, chewing gum, and weight-control products.

Sugar alternatives find applications in beverages, cosmetics and personal care, food, and others. The food segment caters to frozen, bakery confectionery, dairy, and others. Sugar alternatives are mostly added to beverages, like flavoured water and diet carbonated drinks, to name a few. Stevia is one of the most popular sugar alternatives that are used in beverages. It has low calorie content and no glycemic index and is therefore used in numerous forms of energy drinks, ready-to-drink teas, soft drinks, fruit juices, and flavoured water.

Sugar alternatives are sold through distribution channels that are either store-based or not. The store-based distribution channels are specialist retailers, convenience stores, supermarkets and hypermarkets, and others.

Growth Boosters and Impediments

Easy consumer access to expansive information has expedited the awareness levels regarding different nutrition. This has led to higher consciousness and has prompted consumers to make healthier choices when it comes to drinks and food. They are increasingly opting for low-calorie and healthier food and beverages in line with the soaring health issues. In 2018, reports confirm that the prevalence of obesity was close to 40% among individuals aged between 20 and 39 years, while 45.8% were middle-aged. The surge in these health issues has resulted in a rise in the demand for low-calorie and healthy food products among consumers.

Sugar alternatives are consumed by individuals interesting in maintaining their weight while these are also preferred by diabetic patients. Artificial sweeteners do not have carbohydrates, and therefore, do not elevate the blood sugar levels. The most popular and preferred sugar alternative is Stevia, which is much sweeter compared to sugar and contains no calories.

Most of the leading brands are channelizing their focus on developing new products backed by vigorous RD activities and use of the latest manufacturing technologies. The result is production of sugar alternatives of better quality that are cost-effective. These brands also work on boosting the consumer awareness about the toxic health effects of sugar, while developing products that strictly adhere to the global quality standards.

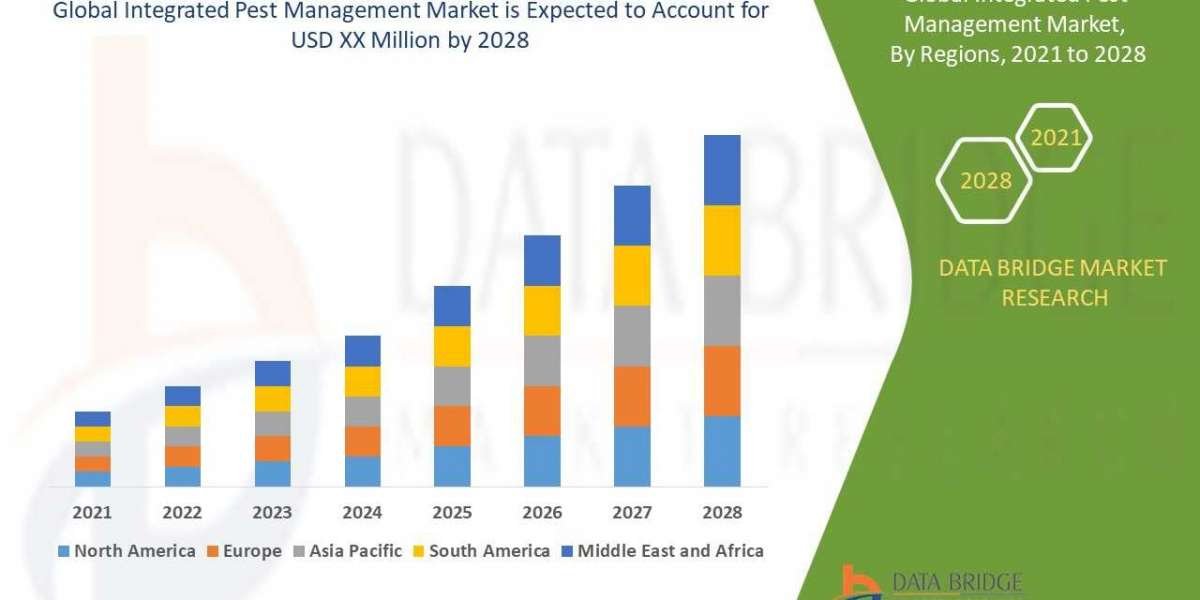

Regional Insight

Europe, Asia Pacific/APAC, North America, as well as RoW/rest of the world are the sugar alternatives market share.

North America is all set to procure the leading position in the coming years, given the significant awareness level among consumers about different food products in line with growing focus on health. Prevalence of healthy diets and the high purchasing capacity of the consumers in the region also add to the market’s strength. Companies in the region are mostly focused on developing beverages and foods that cater to the customers’ dietary and weight loss goals, which helps bolster the sales.

Asia Pacific has been witnessing dramatic changes in terms of diet diversification, relaxation of trade policies within the food industry and rapid urbanization. Consumer’ rising interest in health maintenance and the subsequent shift towards food items with health benefits should present major opportunities to the top sugar alternative manufacturers in the region. The disconcerting surge in cases of obesity and diabetes, especially in India, will foster the adoption of sugar alternatives in the following years.

Recent News

April 2021

Manus Bio Inc., a reputed US developer of sustainable natural ingredients, has launched NutraSweet Natural, which is a plant-based sweetener that as no calories and infuses sweetness to food products. Manus Bio has been working on facilitating calorie reduction via their products that are based on a special green technology that imbibe natural sweetness-inducing ingredients while also reducing environmental footprint.

NOTE: Our Team of Researchers are Studying Covid19 and its Impact on Various Industry Verticals and wherever required we will be considering Covid19 Footprints for Better Analysis of Market and Industries. Cordially get in Touch for More Details.

Contact us:

Market Research Future (part of Wantstats Research and Media Private Limited),

99 Hudson Street,5Th Floor, New York, New York 10013, United States of America

Related Reports