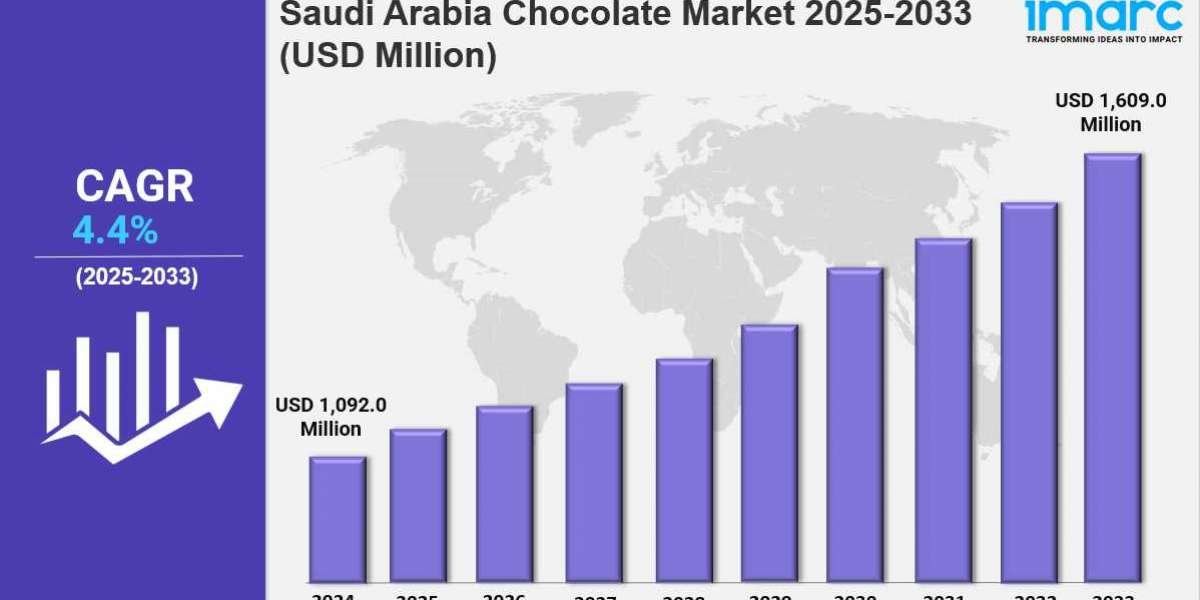

Market Overview 2025-2033

Saudi Arabia chocolate market size reached USD 1,092.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,609.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.4% during 2025-2033. The market is expanding due to increasing consumer demand, rising disposable incomes, and a growing preference for premium and imported products. Innovation in flavors, packaging, and health-conscious options is driving growth. Seasonal demand, gifting trends, and retail expansion contribute to a vibrant and competitive industry.

Key Market Highlights:

✔️ Strong market growth driven by rising disposable income and gifting culture

✔️ Increasing demand for premium, sugar-free, and dark chocolate variants

✔️ Expanding availability through supermarkets, specialty stores, and e-commerce platforms

Request for a sample copy of the report: https://www.imarcgroup.com/saudi-arabia-chocolate-market/requestsample

Saudi Arabia Chocolate Market Trends and Drivers:

The Saudi Arabia chocolate industry is undergoing significant transformation, driven by shifting consumer preferences, regulatory changes, and health-conscious trends. As of mid-2024, over half of consumers under 35 favored low-glycemic-index chocolates, reflecting concerns over rising diabetes rates, which now affect 18% of the adult population. Government initiatives, such as the Quality of Life 2030 program, are reinforcing healthier consumption habits. In response, both global and domestic brands are adapting. Mondelez, for example, launched a sugar-free Cadbury line tailored for the GCC, which saw a 120% increase in regional sales.

Local producers like Bateel are integrating tradition with innovation, offering dark chocolates infused with dates, camel milk, and added nutrients like vitamin D and magnesium. These products are typically priced at a 28% premium. Regulatory updates are also supporting industry growth. The Saudi Food and Drug Authority (SFDA) introduced front-of-pack nutrient labeling in 2024, accelerating product reformulations. However, perceptions of "healthy chocolate" remain a barrier—63% of consumers believe better-for-you options compromise on taste. Price sensitivity, especially among lower-income consumers, also limits broader market penetration.

To address this, brands are testing alternative outreach methods. Almarai, for instance, ran a pilot program offering dietitian-endorsed chocolate samples in Riyadh gyms, converting 41% of first-time tasters into repeat buyers. E-commerce is playing an increasingly central role. In 2024, 58% of premium chocolate sales occurred online, with platforms like Nana Direct and HungerStation tailoring product recommendations based on shopping habits and seasonal events such as Ramadan. Mars KSA’s influencer campaign—featuring limited-edition Snickers Hijab boxes designed by local artists—sold 15,000 units within 72 hours through livestreams on TikTok.

Transparency and traceability are gaining importance in the premium segment. Brands like Patchi now use blockchain to verify cocoa origins and track carbon emissions. Meanwhile, niche digital sales channels—such as private groups on WhatsApp and Telegram—are emerging, with subscription-based clubs offering early access to in-demand imports like Japan’s Royce’ Nama Chocolate. Omnichannel strategies are also advancing. Hershey’s Click-and-Mortar concept in Jeddah, for example, allows customers to 3D-print personalized chocolate products ordered online.

Chocolate remains a key part of Saudi Arabia’s SAR 30 billion gifting culture, often featured in weddings, corporate events, and religious celebrations. Heritage blends with luxury in collections like Godiva AlUla, whose date and rose-infused chocolates achieved a 93% sell-through rate during Eid al-Fitr. Artisan makers such as Chocoline are redefining high-end confectionery with creations like the 24K gold-leaf Saffron Gold bar, priced at SAR 950 ($253) and marketed as a collectible.

Business-to-business (B2B) innovations are expanding as well. Nestlé KSA recently introduced a platform for custom KitKat bars featuring engraved logos, capturing 17% of the local B2B gifting segment. Rising global cocoa prices—up 62% year-over-year—pose a challenge to mid-range products like Dairy Milk. In response, brands are focusing on “smart premiumization.” Ferrero’s Rocher Date edition, for example, uses local ingredients to offset import costs while maintaining a 22% premium.

The Saudi chocolate market is expected to reach $2.1 billion by 2027. Growth is being driven by three main factors: health-conscious innovation, digital infrastructure, and cultural emphasis on premium gifting. With 70% of the population under 35, demand is growing for new formats such as chocolate-covered protein snacks and CBD-infused truffles, which became available in 2024 following regulatory approval.

While Riyadh and Jeddah continue to dominate premium sales, secondary markets like Dammam are gaining traction. Lindt’s launch of three Chocolate Lounges in the Eastern Province in 2024 exemplifies this trend. On the production side, Saudi Arabia is working to establish itself as a cocoa-processing hub, with Neom planning climate-neutral chocolate production via solar-powered factories.

However, challenges persist. Red Sea shipping disruptions have led to a 19% rise in Belgian chocolate import costs. In addition, consumer behavior is shifting—68% of Gen Z shoppers now prefer independent brands over legacy names.

Looking forward, product innovation is expected to diversify further. In 2024, Albaik’s fried chicken-flavored chocolate sparked widespread attention, and Mars is set to trial dynamic pricing strategies during the Hajj season. Meanwhile, Saudization policies mandating a 30% local workforce in food manufacturing are accelerating domestic RD. These developments position Saudi Arabia as an increasingly influential player in the global chocolate industry.

Saudi Arabia Chocolate Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Saudi Arabia chocolate market forecast. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product Type:

- White Chocolate

- Milk Chocolate

- Dark Chocolate

- Others

Breakup by Product Form:

- Molded

- Countlines

- Others

Breakup by Application:

- Food products

- Bakery Products

- Sugar Confectionary

- Desserts

- Others

- Beverages

- Others

Breakup by Pricing:

- Everyday Chocolate

- Premium Chocolate

- Seasonal Chocolate

Breakup by Distribution:

- Direct Sales (B2B)

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145